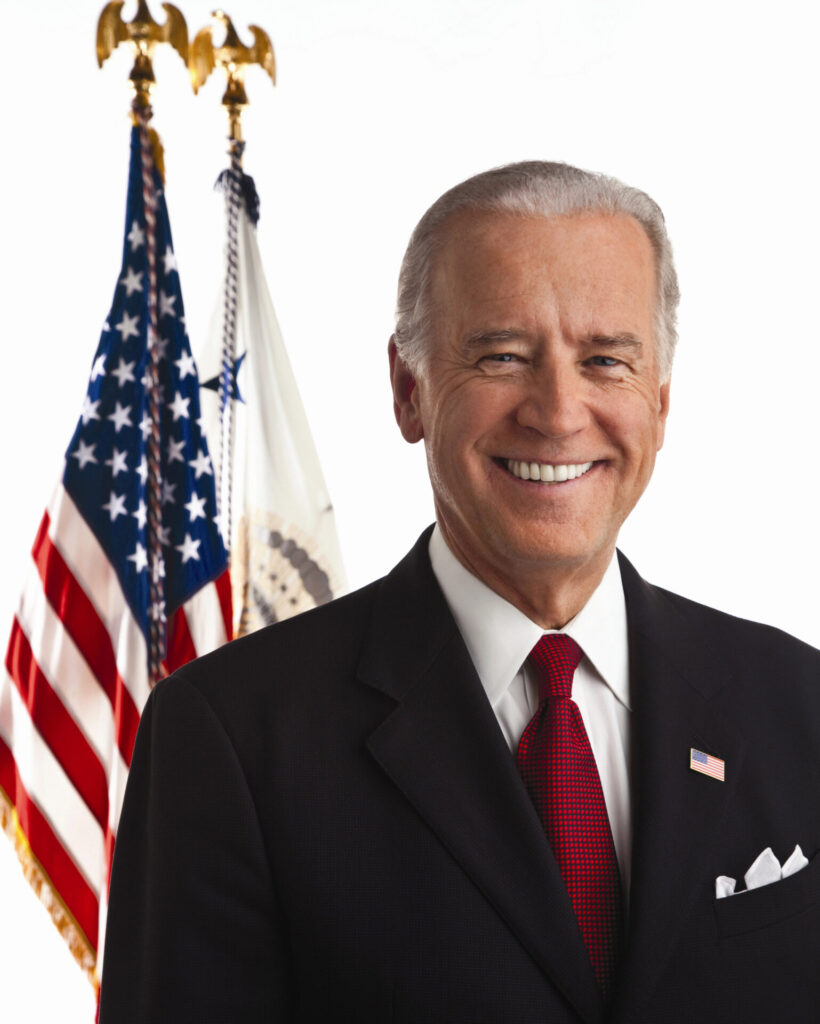

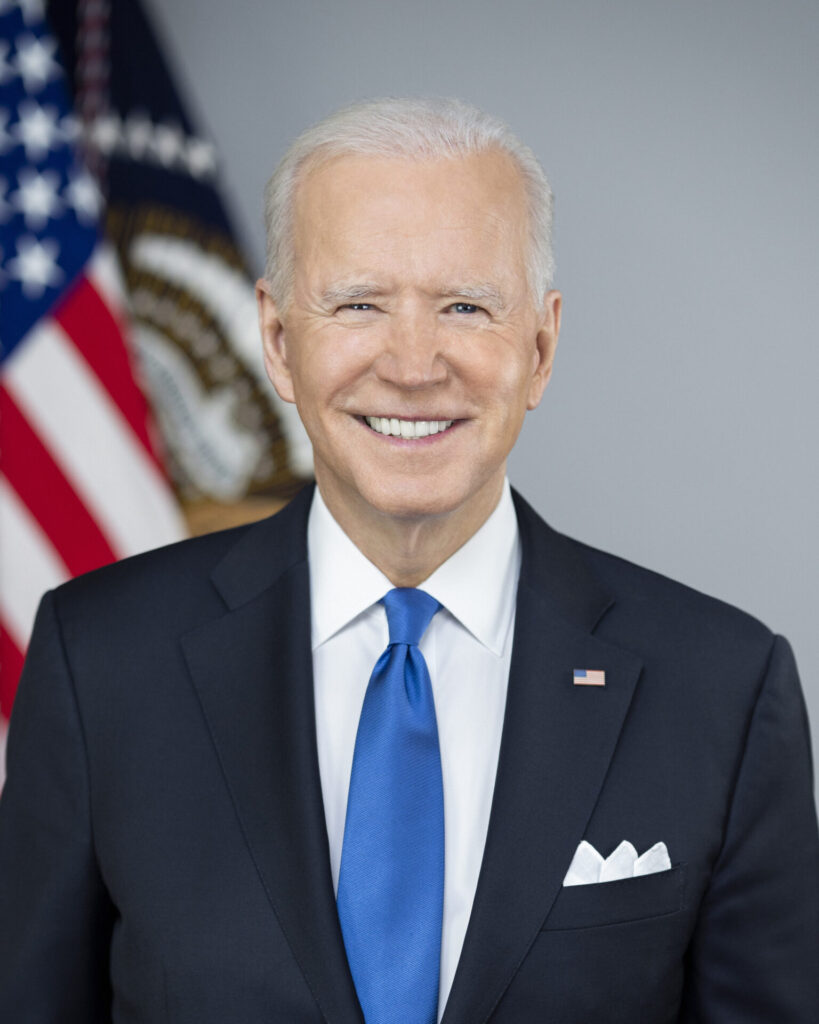

On Tuesday, President Joe Biden announced a set of plans to lower housing costs. This year, inflation and high home prices are likely to be very important problems for voters.

Congress has to agree to the plan, which is made up of two parts. As of this year and for the next two years, the first plan says that landlords who raise rents by more than 5% per year should lose their tax credits. Officials from the White House say that the plan would only apply to owners with more than 50 rental units. This includes more than 20 million rental units across the country.

The Biden administration asked several government agencies to look into whether they could use extra federally owned land to build affordable homes. This is what the White House said happened. For instance, the Bureau of Land Management said it would let people speak on the sale of 20 acres of public land in Nevada at less than market value to make affordable housing. The US Postal Service also said it wants to turn some empty properties into homes.

According to the GOP’s policy platform for 2024, certain areas of government lands should be made available for building new homes.

Todman, who is acting as secretary of housing and urban development, and Biden revealed on Tuesday that seven cities would each get $325 million in grants to “build more homes and revitalize neighborhoods.” Challanooga, Houston, Miami, Las Vegas, Syracuse, Trenton, New Jersey, and Huntsville, Alabama are some of these towns.

There would be an exception to the rule for buildings that are being completely remodeled or built from scratch. That’s meant to encourage the building of new rental homes and flats so that there are more options for people looking to rent.

In a statement, Biden said, “Other administrations gave special tax breaks to corporate landlords. I’m working to lower housing costs for families.” “Democrats and Republicans in Congress should work together to pass my plan to lower housing costs for Americans who need it right now.”

Even though inflation is going down overall, the cost of living is still a big problem for a lot of Americans. An important study from the Joint Center for Housing Studies at Harvard University says that in 2022, a record-high 22.4 million renter households spent more than 30% of their income on rent and utilities. In the last three years, that’s a rise of two million households.

As of last week, new data on inflation showed that the cost of housing went up at the slowest rate in three years in June. But housing prices went up 5.2% a year, which was more than the general rate of inflation.