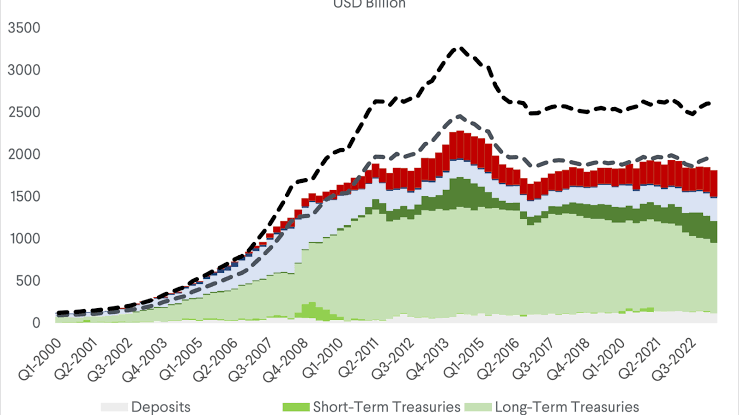

China’s recent actions in its bond market have made people more worried about the country’s financial security. Analysts say that these acts show that people are more worried than ever about possible risks in the financial sector. The sovereign bond market, which is an important part of the financial system, has become the centre of attention as the government tries to control the situation and reduce turmoil.

The action is being taken during a big rally in the bond market, where yields are dropping very quickly. This trend has been especially strong in China, where the bond market is an important part of the country’s banking system. Alicia Garcia-Herrero, chief economist for Asia-Pacific at Natixis, said that the bond market is the “backbone” of the financial sector and that it plays a key role even in economies like China’s that are largely driven by banks.

China Takes Action: Government Intervenes in Bond Market to Address Financial Stability Concerns

One of the main reasons for the involvement is that Chinese insurance companies have changed how they hold their assets in a big way. These companies have been putting more and more of their money into bonds because they promise fixed return rates on life insurance and other goods. Since bond yields have gone down, the value of these investments has gone up, which is a big problem for the business. Edmund Goh, head of China fixed income at Abrdn, brought this up and said that the fast drop in yields has made things hard for insurance companies that have to give clients fixed returns.

The Chinese government’s action is meant to calm these financial worries by securing the bond market and stopping it from becoming even more unstable. The move is part of a larger plan to keep the economy stable and deal with the risks that come with bond prices going down. The Chinese government wants to make sure that the financial system stays strong and stable even when the economy changes by getting involved in the market.

China’s bond market is an important part of the world’s financial system, and how well it does can affect many other markets. The latest action shows how important it is to keep things stable in this area, especially since the country is facing tough economic problems. It is very important for the bond market to provide liquidity and encourage investment. Problems in this area could have big effects on both domestic and foreign financial markets.

Stabilizing the Market: China’s Latest Move to Control Bond Yields and Protect Financial Sector

The intervention not only addresses current concerns, but it also shows a planned way to handle longer-term risks. Taking proactive steps, the Chinese government is trying to stop problems that could happen because of more changes in bond rates. In order to protect the stability of the financial system and keep the bond market working well, this method is being used.

Overall, China’s actions in the bond market show that the country is determined to keep the economy stable even though things are changing in the economy. The steps that the government took are part of a larger effort to handle risks and make sure the banking sector is strong. Because the bond market is so important to the world’s economy, experts and investors will be keeping a close eye on how well these steps work as the situation changes.

Bond Market Boost: China’s Intervention Highlights Efforts to Manage Financial Risks Amid Falling Yields