The Federal Reserve made the most important change to monetary policy of the year when it raised its benchmark interest rate by 0.25 percentage points. The central bank’s decision to take this action to lower inflation shows its dedication to keeping the economy stable. The decision, which was closely watched by markets around the world, shows how hard it is for the Fed to balance supporting growth with keeping inflation low.

The rate hike comes at a time when the economy is uncertain and inflation has been consistently above the Federal Reserve’s 2% goal. Over the past year, inflation has been caused by problems in the supply chain, a lack of workers, and higher market demand. Prices for goods and services have gone up because of these things, which has made people worry about their ability to buy things and the business as a whole.

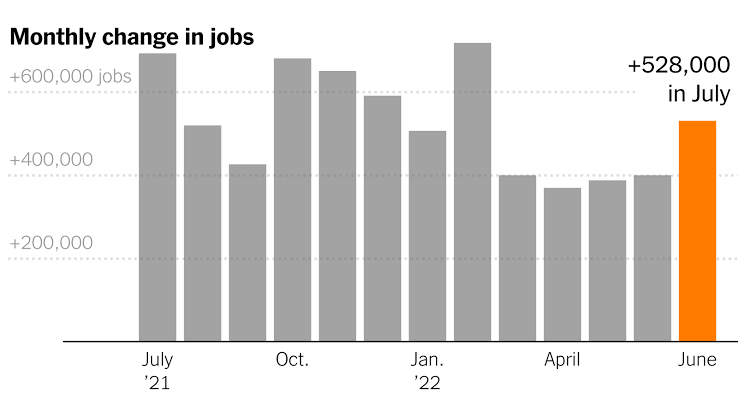

July Jobs Report: Steady Gains Highlight Resilient Economy

During a news conference, Federal Reserve Chair Jerome Powell stressed how important it was to raise interest rates. Powell said that the choice wasn’t made without much thought because it could affect how much people and businesses pay to borrow money. He did stress, though, that the move was necessary to keep inflation from getting out of hand, which could hurt the economy more in the long run.

Several areas are likely to feel the effects of the rate hike right away. Since mortgage rates are closely linked to the Fed’s base rate, they are likely to go up, which will make home loans cost more. This might help cool down the home market, where prices have gone through the roof because of low interest rates and high demand. On the other hand, people who save might gain from higher interest rates on their deposits, which would give their savings a small boost.

When the news came out, the stock market was careful. Investors were weighing the effects of higher borrowing costs against the possibility of slower inflation, which caused major markets to go up and down. Financial experts say that people may have mixed feelings at first, but the long-term picture could be good if the rate hike controls inflation without slowing down economic growth.

Higher interest rates may make things harder for small businesses that borrow money to run their businesses. The higher interest rates on loans could make people less likely to spend and grow. But some experts say that a small rate increase might spur companies to become more efficient and focus on long-term growth plans.

The Fed’s decision is expected to have effects on other countries. A lot of other countries use the U.S. central bank as a model for their own money policies. If the Fed raises interest rates, other central banks might think about doing the same to fight inflation in their own economies. Also, higher interest rates in the U.S. could make the dollar stronger, which could make American products more expensive and possibly change the balance of trade around the world.

Slow and Steady: US Job Market Shows Consistent Growth in July

The rate hike could also have an effect on how people feel about buying things. Higher interest rates on loans could make people spend less, which is important for economic growth. But if the Federal Reserve is able to stop inflation, prices may stay stable for longer, which could be good for buyers.

In conclusion, the Federal Reserve’s choice to raise its key interest rate by 0.25 percentage points is a major turning point in the current state of the economy. The goal of the move is to deal with the ongoing problem of inflation, but it could also have risks and effects on many other areas. It will be important to keep an eye on how different parts of the economy react and change as the effects of this policy change play out. The Fed’s skill at finding the right mix between keeping inflation low and boosting growth will have a big impact on the economy in the coming months and years.