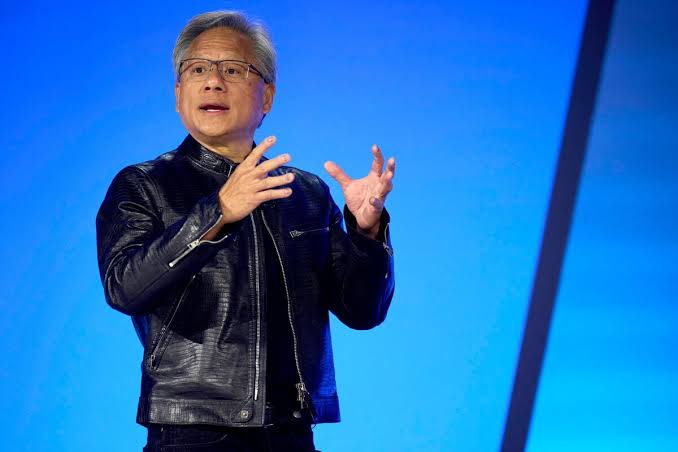

Nvidia has become the most important stock in the world, which is both an honour and a lot of pressure as the company prepares to release its earnings report. The semiconductor giant’s important role in the tech industry, along with its recent performance and market impact, have made it a major focus for investors, analysts, and people who follow the industry.

Many people know Nvidia as the leader in graphics processing units (GPUs), and the company is also growing in the artificial intelligence (AI) and data centre businesses. GPUs from this company are now necessary for a wide range of uses, from games and virtual reality to professional visualisation and deep learning. Nvidia is a key player in a number of high-growth industries because its technology is essential to progress in AI, machine learning, and high-performance computers.

Nvidia emerges as the world’s most crucial stock, with a high-stakes earnings report just around the corner.

The stock success of the company has been nothing short of amazing. It is worth more than it used to be because more and more businesses are using Nvidia’s products and technologies. The fact that the stock is in major market indices and is a favourite among institutional buyers shows how important it is. Because of this, Nvidia’s earnings report has become a big deal in the world of finance, with a lot of hopes and predictions riding on it.

The earnings report that is coming out soon will be very important for Nvidia because it will show how the company is doing financially and what its plans are for the future. Analysts and buyers will look very carefully at the report to find signs of growth, profit, and market share. Because Nvidia is such a big company, the earnings report is expected to have a big effect on market trends and investor mood in general.

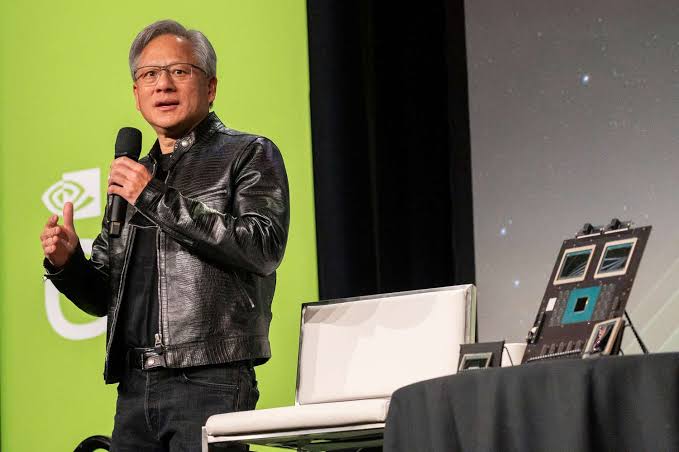

With its status as the top global stock, Nvidia faces intense scrutiny ahead of its upcoming earnings announcement.

There are a lot of worries about Nvidia’s earnings report for a number of reasons. First, the company’s fast growth and position as the industry leader set high standards for continued strong performance. Any changes from these predictions could cause big changes in the market. Investors are most interested in metrics like sales growth, profit margins, and guidance for the next few quarters. These will be carefully looked at to see how the company is doing.

The second thing that makes the earnings report more complicated is Nvidia’s role in the AI and data centre businesses. The company has set itself up as a key driver of AI innovation, and its success in these areas is essential for it to stay ahead of the competition. The earnings report will give us important information about how Nvidia is doing in these key areas, such as how well its AI-focused goods and solutions are selling.

Nvidia also has to deal with competition from other tech giants and semiconductor makers. As the market for GPUs and AI technologies gets more competitive, Nvidia needs to show that it can keep leading the way and coming up with new ideas. The earnings report will show how well Nvidia is handling these changes in the competitive landscape and whether it can continue to do better than its rivals.

The spotlight is on Nvidia: As the world’s most important stock, its forthcoming earnings report is set to be a major market event.

Finally, the fact that Nvidia is the world’s most important stock shows how much of an effect it has on the tech industry and the market as a whole. The earnings report that is coming out soon will be very important for the company’s future and for investors’ faith in it. All eyes will be on Nvidia as it gets ready to share its financial results to see how it handles the pressures and expectations that come with being a market leader. The study will show not only how Nvidia’s business is doing but also how it should move forward in an industry that is changing quickly.