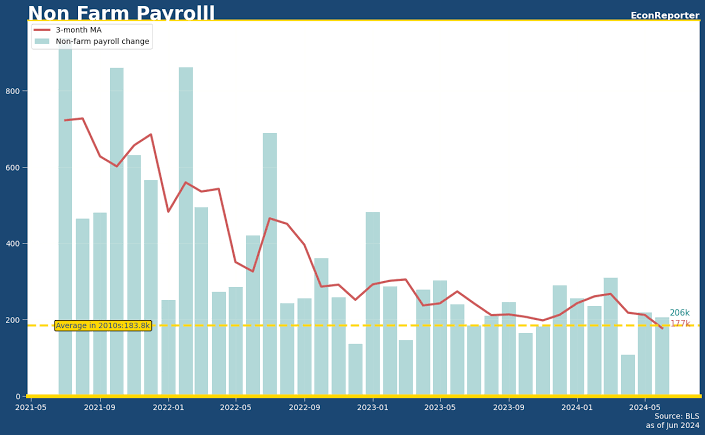

The U.S. Labour Department recently lowered its predictions for nonfarm payroll growth by an amazing 818,000 jobs. This shows how unstable and unpredictable the job market has become since the pandemic. The changes in this revision are for the 12 months finishing in March 2023, and they are one of the biggest drops in recent years. The change makes it seem like the job market might not have been as strong as first thought, which makes people worry about the overall economic rebound.

The nonfarm payroll shows how many jobs were gained or lost in the U.S. economy, excluding jobs on farms, in private households, and at nonprofits. It is a very important sign of economic health. Because of the most recent change, economists and lawmakers have a new perspective on how strong the job market is. This big of a drop in the numbers suggests that the original reports may have been too optimistic about job growth during the recovery time. This makes people question how reliable the first reports were.

Revised Reality: The U.S. job market might not be as strong as we thought, with nonfarm payroll growth slashed by 818,000 jobs.

The negative revision mostly impacts the private sector, where job growth rates dropped the most. Some of the areas that got the most changes were professional and business services, leisure and catering, and leisure and business services. Many experts were shocked by this change because they thought that these areas were leading the recovery from the pandemic. The changes show that the recovery in these fields wasn’t as strong as was first thought, which makes it less likely that their growth will continue.

There are a number of things that economists say may have caused the initial overestimation of job growth. It was probably because of how quickly things got back to normal after the pandemic and how hard it was to get accurate numbers when the job market was down. Also, the method used to estimate job growth, which depends a lot on business surveys, might not have been able to keep up with the changes in employment trends during this time.

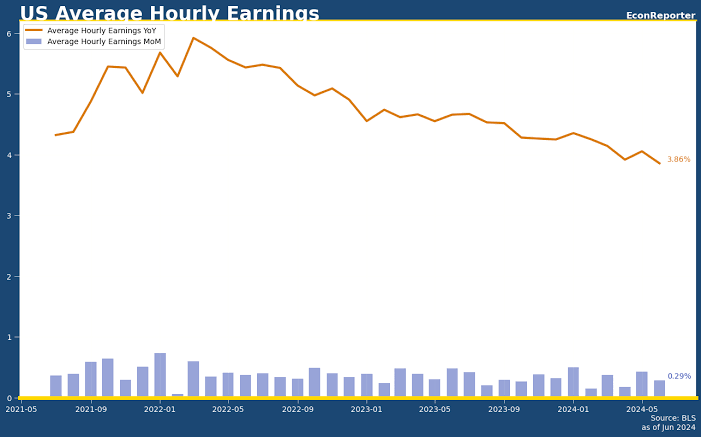

The change has big effects on the way money is managed. As it makes decisions about interest rates, the Federal Reserve has been keeping a close eye on the job market. Since the new data shows that job growth is slower, the Federal Reserve may be less eager to tighten monetary policy. Inflation needs to be kept under control, but the central bank doesn’t want to slow down economic growth. The Fed might change its mind after seeing these new numbers, which could delay further interest rate hikes.

Economic recalibration: The Labor Department revises nonfarm payroll data, revealing a significant overestimate in job growth.

Businesses may need to rethink their growth plans after seeing the new data. Companies that planned to hire people based on a better job market may need to rethink their plans, especially in industries that have been hit the hardest by the changes. As companies get used to the new economic situation, this could slow the creation of new jobs over the next few months.

There are also political effects of the change. Strong job growth has been a big point of pride for the Biden government as a sign of its economic success. However, the big drop in prices may give critics more evidence to say that the rebound has been uneven and overstated. The government will have to deal with these complaints while keeping its attention on its larger economic goals.

A closer look at the numbers: 818,000 fewer jobs than initially reported—what does this mean for the U.S. economy?

In conclusion, the Labour Department’s change of 818,000 jobs in nonfarm payroll growth shows how hard it is to measure economic rebound when things are changing so quickly. The changes make people worry about how strong the job market is and how that affects monetary policy, business planning, and political storylines. As the economy changes, it will be important to have accurate and up-to-date facts in order to make smart choices.