A company that specialises in accounting has issued a warning to businesses about a compelling hoax letter that impersonates the HMRC taxpayer office.

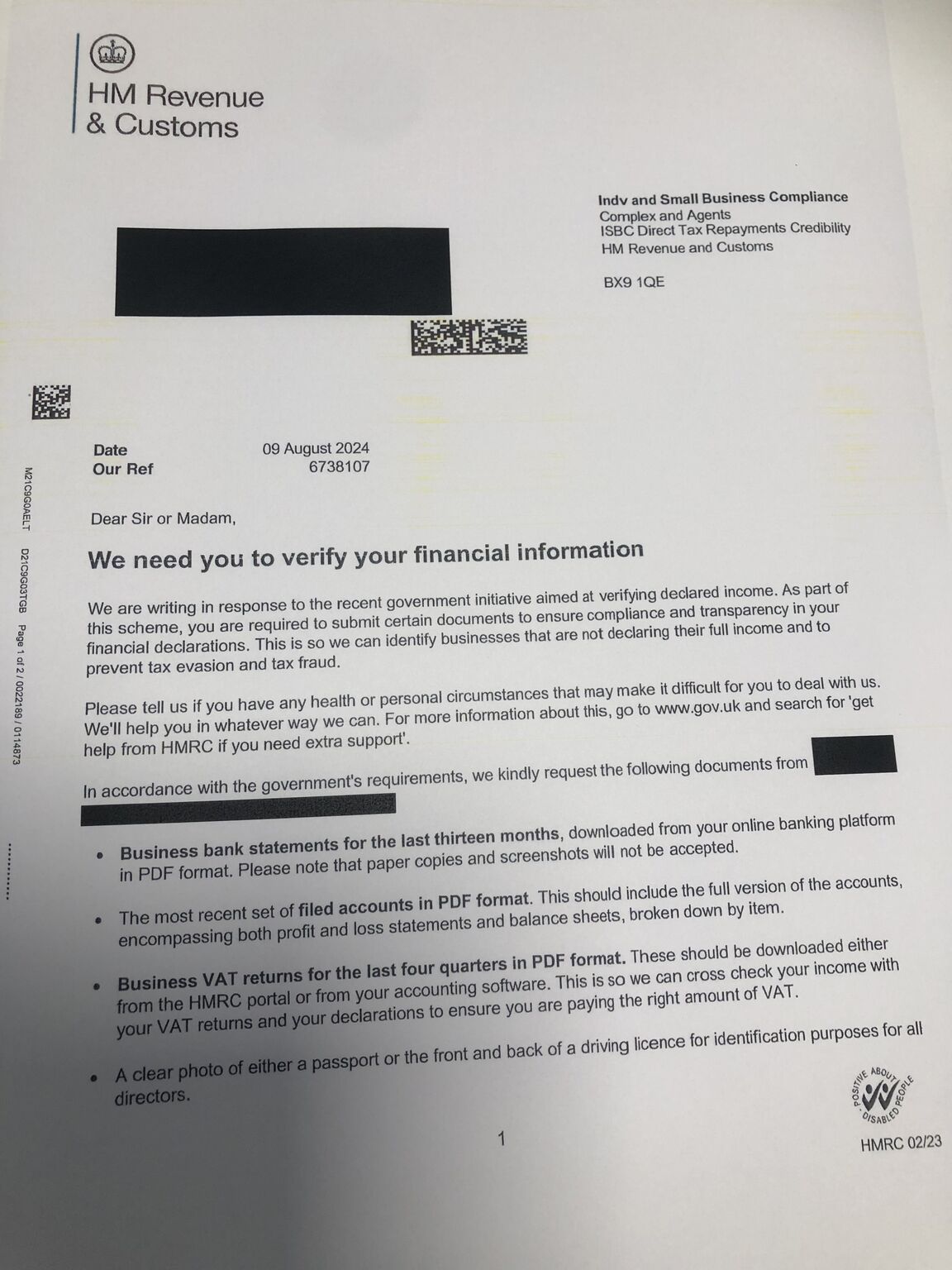

The message uses a font that closely resembles the style of a letter that the High Revenue and Customs organisation would send, saying, “We need you to verify your financial information.”

In a post that went live on social media on Friday, the Azets accounting firm exposed the fraudsters. The post displayed a letter that had been written to one of the company’s clients.

According to Sajid Ghufoor, who is the head of Azets’ tax investigation and dispute resolution services, “A client received the letter below and believed it to be genuine. However, my colleague Jemima Jones was suspicious, and after closer inspection, we identified that it was a scam, as the email address is not one that HMRC has ever used.”

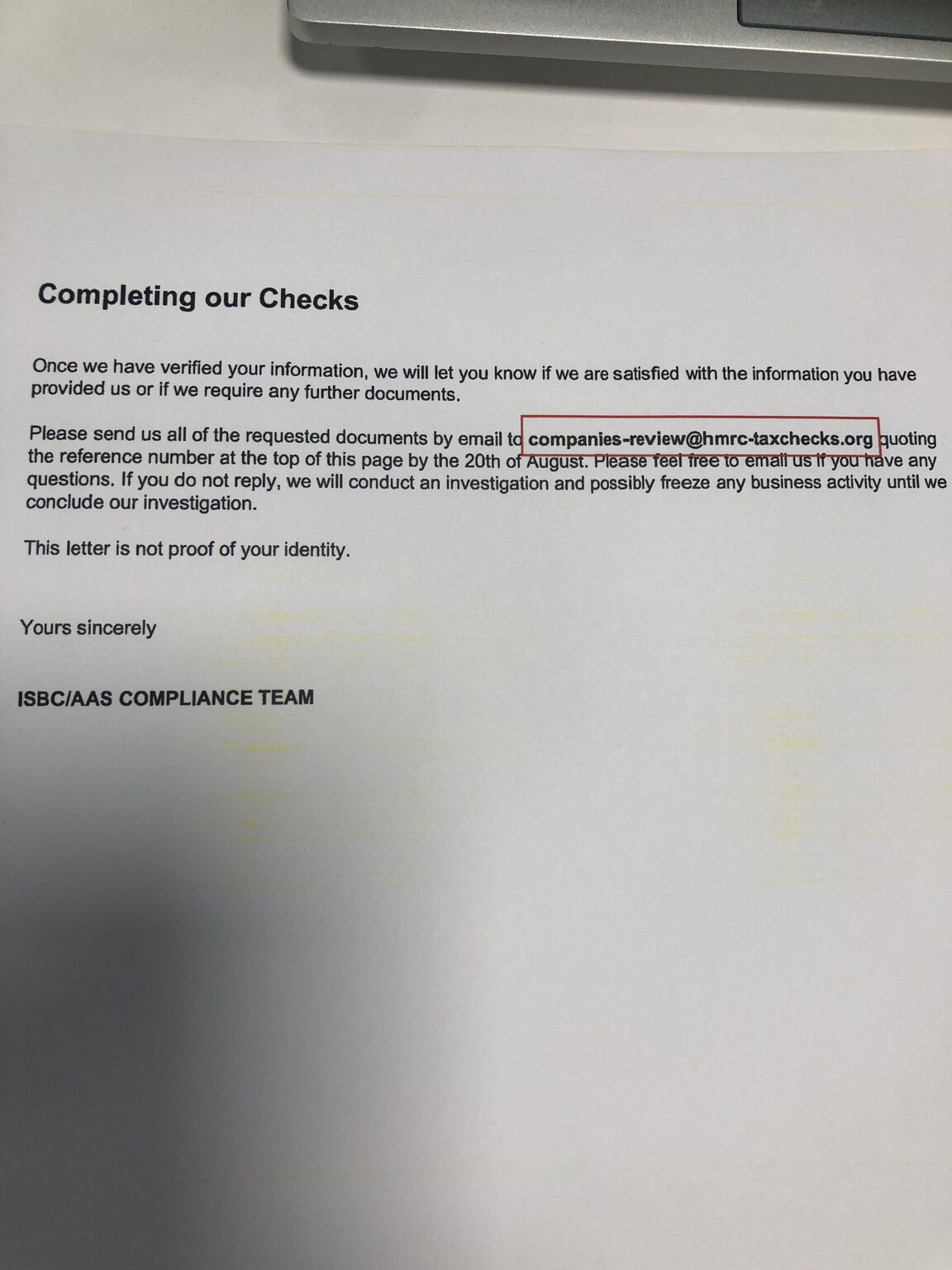

According to Ghufoor, the most obvious incriminating factor was the email address that the con artist used, which reads companies-review@hmrc-taxchecks.org. The fact that the email address does not include a government ending is revealed.

Following the receipt of information about the fraud through their phishing mailbox on Friday morning, the HMRC issued an urgent scam alert at that time.

According to a representative for the HMRC, “criminals are remarkable pretenders.” They employ a variety of strategies in an effort to deceive citizens, and they frequently imitate signals from the government in order to make them appear genuine.

“Tax frauds can take many different shapes. You may receive a refund from some, be informed that your tax information is out of date by others, or be threatened with immediate arrest for tax avoidance by others. Do not ever allow yourself to be hurried. In the event that you receive a call from someone claiming to be from HMRC and requesting that you transfer money or provide personal information immediately, you should be on the lookout. In addition, we will never call and threaten to arrest someone. Whoever does that is a criminal.

“Unexpected contacts such as these should set alarm bells ringing, so take your time and check out the suggestions for HMRC scams that are available on GOV.UK.”

The sender’s address was not legitimate on Google Maps, and the letter contained words that were similar to those in the HMRC, according to the image that Sajid Ghufoor shared. For example, the message stated, “Please tell us if you have any health or personal circumstances that may make it difficult for you to deal with us.”

The following statement by a scammer demonstrates their use of harsh language: “If you do not reply, we will conduct an investigation and possibly freeze any business activity until we conclude our investigation.”

Action Fraud, the national fraud reporting centre in the United Kingdom, brought attention to the fact that scams were not limited to the postal service by declaring, “Watch out for these fake HMRC emails; they’ve been reported to us over 700 times this month!”

In a short amount of time, users of X expressed their worries regarding the fraud and pointed out the distinguishing characteristics that differentiated it from genuine HMRC paperwork.

Tax expert Dan Neidle made the following observation: “Woooah, this is a very clever and evil scam.” Web-savvy individuals will immediately recognise the questionable email address, but I bet that a lot of others won’t.

“HMRC are well-targeted by scammers, and they can often replicate very close replicas,” said Nikita Cooper, director of tax at Price Bailey LLP, in an interview with The Independent.

“It is extremely odd for them to ask you to “check your financial information,” since they would never write to you to request that you provide your bank identifying information.

In most cases, compliance inspections will focus on information pertaining to refunds or international transactions.

According to her, the following are some simple methods for checking the letters: Always look at the logo to see if it is distorted. Google the location, you should always check to see if the information matches the online government website where you can report it, and you should never click on any links that are included in emails or texts.