The Challenges and Expectations Surrounding China’s Economic Slowdown

The official figures for the second quarter of 2024 revealed that the growth rate of the Chinese economy was 4.7%, which came as a significant disappointment for the Chinese economy. The performance in the second quarter fell short of expectations, showing a decline compared to the strong first quarter. The Chinese government set a goal of achieving an annual growth rate of around 5%, but it seems to be becoming more challenging to reach this target.

Coincidentally, this economic setback aligns with an important conference of China’s senior officials, referred to as the Third Plenum, where they are addressing the sluggish growth of the country. Although Heron Lim of Moody’s Analytics pointed out that China’s economy slowed down in the June quarter, he emphasized the importance of finding effective solutions based on the ongoing discussions in Beijing.

An important challenge that China’s economy is currently grappling with

China is facing economic challenges as a result of various factors. The ongoing crisis in the real estate market continues to have a major impact on the economy. Despite playing a significant role in China’s economic growth, the real estate industry has faced challenges with debt and defaults, leading to a decrease in consumer confidence and investments in the sector. Furthermore, local governments are grappling with significant levels of debt, which poses a challenge to their ability to stimulate economic growth.

Inadequate consumption remains a significant issue. Consumer confidence remains low despite numerous efforts to boost domestic spending. The high levels of unemployment, especially among the younger generation, exacerbate this issue to a greater extent. The current economic situation has presented a complex set of factors that require prompt and impactful policy actions.

It’s worth mentioning that the Third Plenum holds great historical importance in China’s political and economic sphere. The previous decisions made by the Plenum have had a significant influence on the trajectory that the country has followed. In 1978, Deng Xiaoping, the leader of China, initiated market reforms that allowed China’s economy to become more globally connected. During this transformative era, the foundation was laid for China’s remarkable ascent in economic prowess.

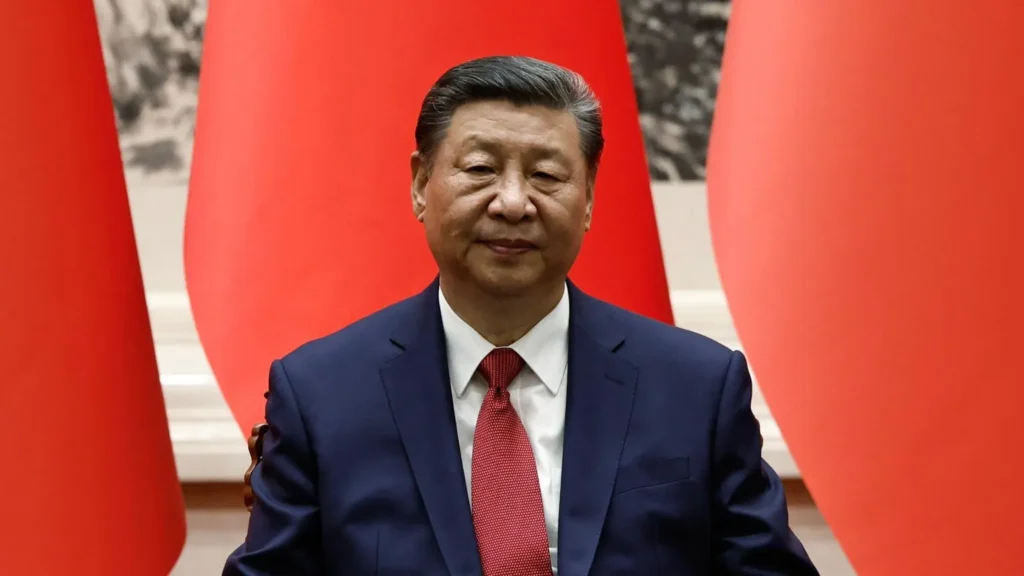

In 2013, President Xi Jinping used the Plenum to signal potential changes to the unpopular one-child policy. This emphasized the importance of the conference in addressing important societal issues. This year, President Xi Jinping is set to preside over a gathering of approximately 370 high-ranking members of the Chinese Communist Party, generating a significant amount of excitement and anticipation. Analysts and observers are closely monitoring any policy moves or pronouncements that could potentially revive China’s economy.

The Chinese real estate industry plays a crucial role in the country’s economy, contributing significantly to its gross domestic product (GDP) and serving as a major investment avenue for Chinese families. However, the industry has faced major challenges. The government’s efforts to regulate borrowing and speculative investments have led to stricter credit conditions, causing concern among property developers.

The recent defaults by large developers have caused significant disruptions in the markets and have eroded customer trust. Outside of the real estate sector, the challenges faced by the property market have had a ripple effect on various other industries, such as construction, steel, and cement, among others. Ensuring the stability of this sector is of utmost importance for the overall economic recovery. That’s why it has become the central topic of discussion in the Third Plenum debates.

Another pressing issue that needs attention is the current debt burden faced by local governments. Many local governments have taken on substantial debt by utilizing corporations that are not reflected on their financial statements. This strategy aims to generate funds for infrastructure projects and promote economic growth. Repaying this debt has become more challenging due to the decline in economic activity.

Efforts to manage and reduce debt for local governments are crucial. It is crucial to have policy measures in place that not only enable local governments to receive financial assistance, but also promote more environmentally responsible borrowing practices. Striking a balance is crucial to ensure that local governments can maintain their role in economic development without exacerbating financial risks.

China’s economic authorities are highly focused on boosting domestic consumption. Despite being the world’s second-largest economy, China has faced challenges in transitioning from an investment-driven development model to one that relies more on domestic consumption. Due to the current economic slowdown, the potential dangers of relying too heavily on exports and investments have become apparent.

Measures like tax reductions, government subsidies, and efforts to strengthen social safety nets can all be utilized to enhance consumer spending. Additional steps that are necessary involve addressing the income disparity and increasing the disposable income. Considering the need for a more balanced growth model to ensure long-term economic stability, policymakers are exploring various strategies to boost consumer confidence and spending.

Tackling the Issue of High Unemployment

China is grappling with a significant challenge of high unemployment rates, especially among its younger population. Due to the economic downturn, there has been a surge in job cuts, making it more challenging for recent graduates to secure employment. This not only impacts consumption, but also has broader implications for society.

It is crucial to have policies that prioritize job creation, particularly by offering support to small and medium-sized businesses (SMEs) and investing in emerging industries. In addition, programs and initiatives focused on retraining can help match skills with market needs, which can lead to a decrease in unemployment rates. It is crucial to take immediate action to tackle this issue in order to maintain social stability and economic prosperity.

Expectations Arising from the Third Plenum

Due to the numerous challenges faced by China’s economy at present, it is expected that the Third Plenum will introduce significant policy measures. Analysts are actively searching for solutions to address the crisis in the real estate market, the debt of the local government, the low level of consumption, and the high unemployment rate. The successful implementation of these policies will play a crucial role in shaping the future trajectory of China’s economy in the coming months and years.

Both domestically and internationally, the leadership of President Xi and the decisions made during this Plenum will be closely examined. The outcome of this meeting could have a significant impact on China’s economic policy and global markets.

The recent economic decline in China during the second quarter of 2024 has highlighted the urgent need for effective policy measures to address the various challenges currently faced by the economy. Given the historical significance of the Third Plenum and the high expectations surrounding it, it is crucial for China’s leaders to strategize a path towards long-term economic growth.

Addressing the crisis in the real estate market, managing the debt of the local government, increasing domestic consumption, and addressing the high unemployment rate are among the most crucial initiatives. The decisions made during this Plenum are anticipated to have far-reaching implications for China’s economy and its standing in the global economic landscape. Like many others, people around the globe are eagerly anticipating the actions of China’s leaders, hoping for policies that will foster stability, growth, and prosperity.