However, during their election campaign, Labour refused to specify whether or not they would raise additional taxes, despite the fact that they had stated that they would not hike national insurance, income tax, or VAT.

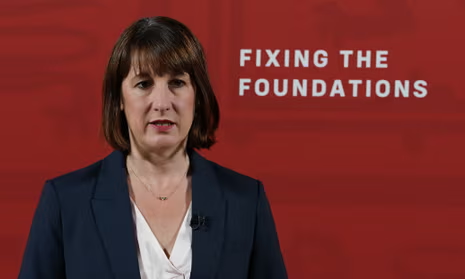

As the chancellor, Rachel Reeves, has stated, it is quite likely that tax increases will be proposed in the autumn budget.

She stated that the Labour Party would fulfil its promise made in the election manifesto to not increase national insurance, income tax, or value-added tax.

During the election campaign, candidates for the Labour Party chose not to respond to queries on whether or not further taxes would be raised. On the other hand, the Conservatives warned that Labour would eventually raise other taxes.

On Tuesday, however, Ms. Reeves stated in an interview with The News Agents podcast that “I think that we will have to increase taxes in the budget.” This was only one day after she had announced various initiatives that would save money.

It was not possible for her to disclose which taxes might be increased during the first budget that the Labour government would present on October 30.

When a person passes away, the value of their estate beyond £325,000 is subject to inheritance tax at a rate of forty percent.

Either raising tax rates or lowering the amount of inheritance that people have to pay could generate revenue.

There are already a number of exemptions, such as those on agricultural land and family enterprises; however, these exemptions could be reduced or eliminated in order to include them.

The government could also restrict the number of years that are permitted for the transfer of assets prior to the initiation of inheritance tax in the event that an individual passes away.

Darren Jones, who is now the chief secretary to the Treasury, was heard on a video that was released in March arguing that inheritance tax might be used to “redistribute wealth” and address “intergenerational equality.”

The tax on capital gains

The profit made from the sale of capital assets, such as second houses, shares, business assets, and the majority of personal items worth the equivalent of six thousand pounds or more, with the exception of automobiles, is subject to capital gains tax.

At the moment, individuals are exempt from paying taxes on the first three thousand pounds of profits, or one thousand five hundred pounds for trusts.

It is possible that the minimal restriction could be eliminated and that the tax would be applied to assets that are no longer exempt.

Along the same lines as the inheritance tax, it is one of the levies that is receiving the greatest attention in terms of being targeted.

He expressed his frustration with the “out of date” council tax system in the audio that was released from Mr. Jones, and he intimated that residences with a value of more than one million pounds would be required to pay a higher tax rate.

In the course of the election campaign, former shadow minister Jonathan Ashworth stated that the Labour Party would not alter the bands allocated to the council tax.

The 1991 value of homes served as the basis for the current council tax structure’s bands. The Institute for Fiscal Studies (IFS) and the Institute for Government (IfG) have both deemed this structure to be “absurd” and “incredibly poorly designed.”

Gemma Tetlow, head economist at the Institute of Finance, stated that the council tax might be altered “in a very sensible way… rather than having the banded system, you could move to something that is much more proportional to land revenue.”

She concluded by saying: “You could do that sensible structural reform and raise some extra money at the same time.”

It is believed that labor is currently consulting on the possibility of revising business rates. Business rates are charges that are levied on the majority of non-domestic properties, with some properties, such as small companies, retail, hotel, and leisure facilities, receiving relief.

The current rateable value, which is an estimate of how much it would cost to rent that property for a year in April 2021, might be changed so that it is tied to the value of the land instead of the current rateable value. This would be a necessary change.

Duty on stamps

In addition to additional payments for second homes and people who don’t live in the UK, stamp duty is due on the price of a property that is more than £250,000.

This is one of the reasons why older people are not moving out of pricier and larger properties, and it is also one of the reasons why individuals are discouraged from moving into their own homes.

There is a possibility that Labour may modify the tax such that it is centered on the yearly land value tax rather than a transaction; however, this might be difficult to convince the party to accept.